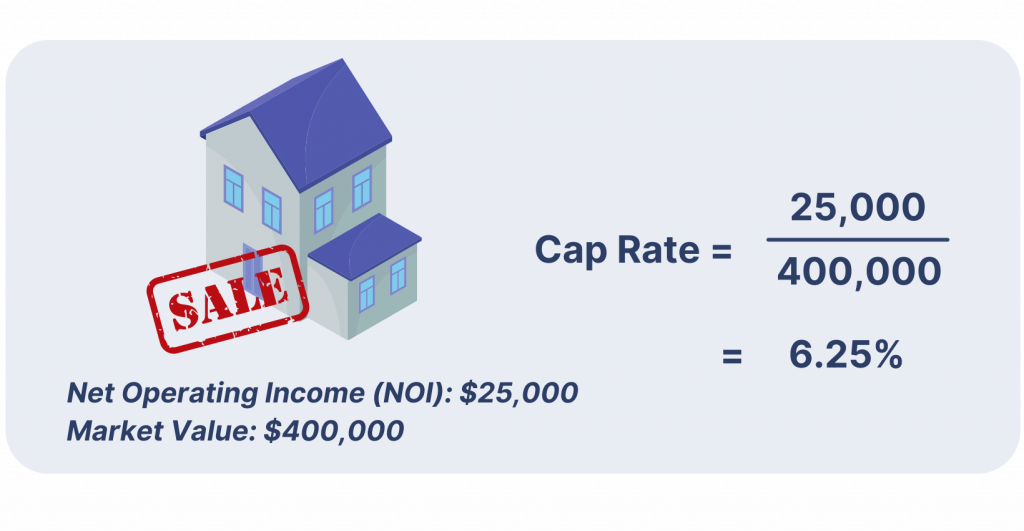

If similar properties in the same market have a cap rate of 6.5%, a home with an asking price of $150,000 should generate an NOI of: Let’s assume a single-family home has a market value of $150,000 with an NOI of $10,500.

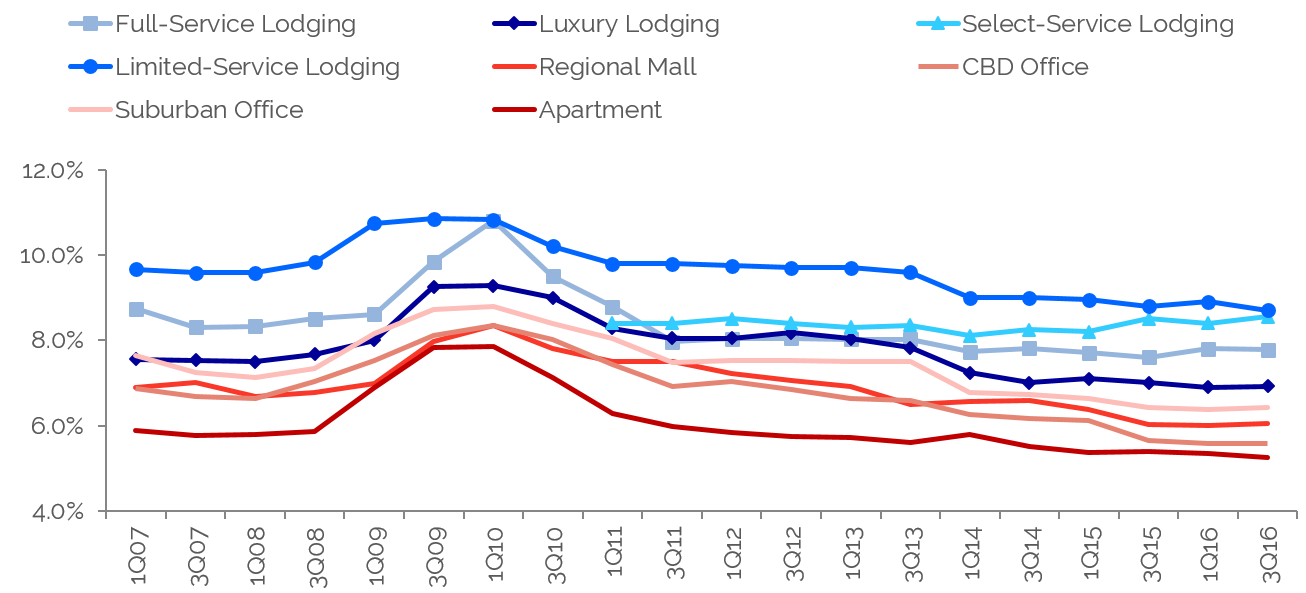

You can also use the cap rate formula to calculate what the NOI should be and what the market value should be, provided you have two of the three variables. Market value is the current value of the property, or the price the property was purchased at if the investment is brand new. NOI is the property’s net operating income excluding any financing costs such as a mortgage payment. On the other hand, many single-family rental houses for sale in a lower cost of living state such as Alabama offer investors cap rates of 6% or more. Learn Moreįor example, some single-family homes in California listed for sale to investors on the Roofstock Marketplace have cap rates of less than 3%. It’s important to understand that cap rates for the same type of property vary from market to market, due to factors such as supply and demand, and the general cost of living. Now let’s look at how real estate investors calculate and use cap rate and cash on cash return.Ĭap rate (short for capitalization rate) measures the return or profitability of similar assets in the same market, submarket, or neighborhood. With the cash on cash return formula, the bottom number is the amount of cash invested, such as the property down payment. In the cap rate calculation, the bottom number is the purchase price or market value. Lastly, the denominator used in the cap rate and cash on cash return formulas is different. Another way of thinking about cash on cash return is that the formula assumes you are obtaining a loan to purchase the home, by following the principle of OPM (other people’s money). All Cash Scenarioįor investors who pay for a property all in cash, the cap rate and cash on cash return results are the same. For example, some investors prefer to use a conservative LTV of 75%, while other buyers with a short-term hold (such as fix-and-flippers) put down as little money as possible. By not including financing costs in the cap rate, investors can make a better apples-to-apples comparison of similar properties in the same area, because how a property is financed and the amount of leverage used varies from one investor to the next.įinancing costs are included when calculating cash on cash return, to measure how much profit is received for each dollar invested.

Mortgage loan costs are excluded from the cap rate calculation but included in the cash on cash return. There are three significant differences between the cap rate and cash on cash return calculations: Financing Costs In this article, we’ll explain how cap rate and cash on cash return calculations work, and why investors should use both metrics when analyzing potential investment property. Cap rate and cash on cash return are two important metrics that real estate investors use to analyze rental property, but each calculation is used for different reasons.

0 kommentar(er)

0 kommentar(er)